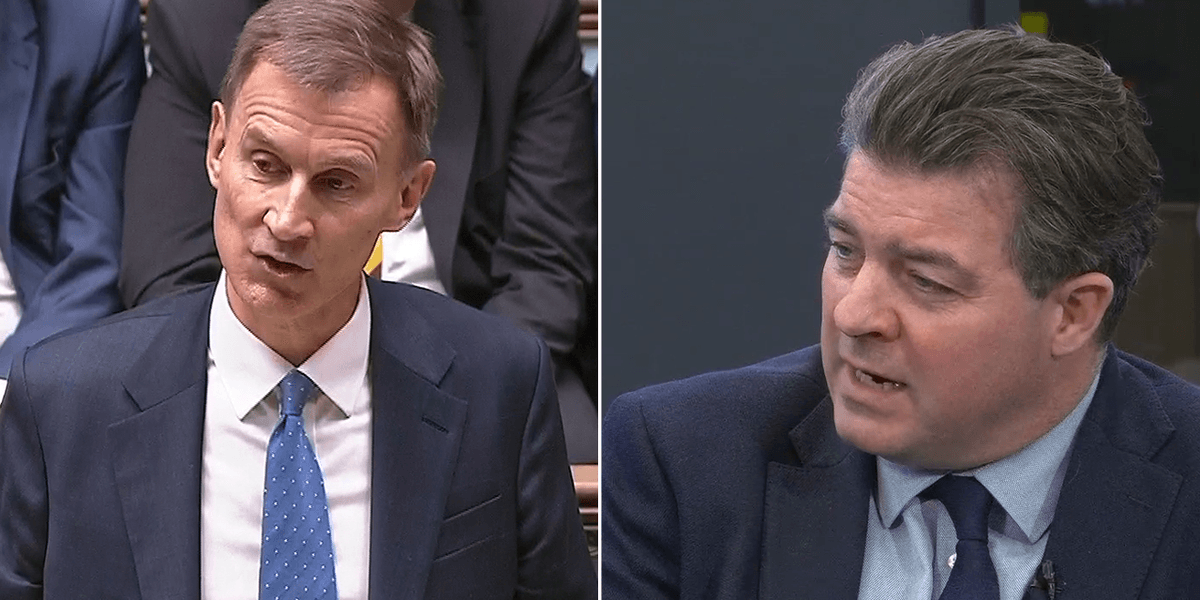

Liam Halligan has hit out at Jeremy Hunt’s “disingenuous” freezing of tax thresholds, arguing the Chancellor is taking the public for a ride.

It comes after the Chancellor cut national insurance in a giveaway worth £10 billion a year, but a freeze in personal tax thresholds remains, wiping out the benefit for many workers.

The GB News Business and Economics Editor called on Hunt to be “more honest”, saying the freezing of tax thresholds amount to a 5-6p increase in the basic rate of income tax.

“If you want to tax that much more, do it and then we can have a discussion about it”, he said.

Liam Halligan has accused the Chancellor of being ‘disingenuous’

PARLIAMENT / GB NEWS

“Some people will agree, some will disagree. To treat the public in a disingenuous way as if they’re stupid, as if they don’t get the fact that if you freeze tax thresholds, they get dragged into higher tax brackets.

“Often the public is ahead of the political class, certainly ahead of most journalists in my experience.”

LATEST DEVELOPMENTS

Halligan said he is “not surprised” at the thresholds remaining in place, saying his experience covering business and economics has resulted in him being naturally cynical on the matter.

“Nothing shocks me. No matter how cynical you are”, it’s never enough”, he said.

“I wish the Chancellor would be more honest with people.”

The Chancellor said the two percentage point reduction in the main rate of employees’ national insurance (NI) will save someone earning £35,000 more than £450 and the change would benefit 27 million people.

The tax cut will be rushed through Parliament to take effect in January as Rishi Sunak seeks to boost his chances at the ballot box.

The changes in the autumn statement reduce the tax burden by 0.7 percentage points compared with forecasts in March, but it still rises to a record post-war high of 37.7% of GDP by 2028-29.

And high inflation has also contributed to a situation where the independent budget watchdog warned that “living standards are forecast to be 3.5% lower in 2024-25 than pre-pandemic”.

“This would be the largest reduction in living standards since records began in the 1950s, but only half the fall we expected in March,” the Office for Budget Responsibility (OBR) said.

Hunt said high employment taxes “disincentivise the hard work we should be encouraging” as he cut the 12% national insurance rate on earnings between £12,570 and £50,270 to 10%.

“If we want people to get up early in the morning, if we want people to work nights, if we want an economy where people go the extra mile and work hard, then we need to recognise that their hard work benefits all of us,” the Chancellor said.