Retirement annuities have experienced a resurgence, with the typical purchase value surpassing £80,000 for the first time in history, according to fresh data from the Association of British Insurers.

The trade body revealed that total premiums flowing into individual pension annuities climbed four year-on-year to hit £7.4billion in 2025, marking the strongest annual performance since pension freedoms were introduced over a decade ago.

These reforms, announced in 2014, gave savers with defined contribution pensions far greater choice over how to access their retirement funds, ending the previous requirement to convert savings into an annuity.

The average annuity value has now reached £84,000, reflecting a significant shift toward larger pension pots being converted into guaranteed lifetime income.

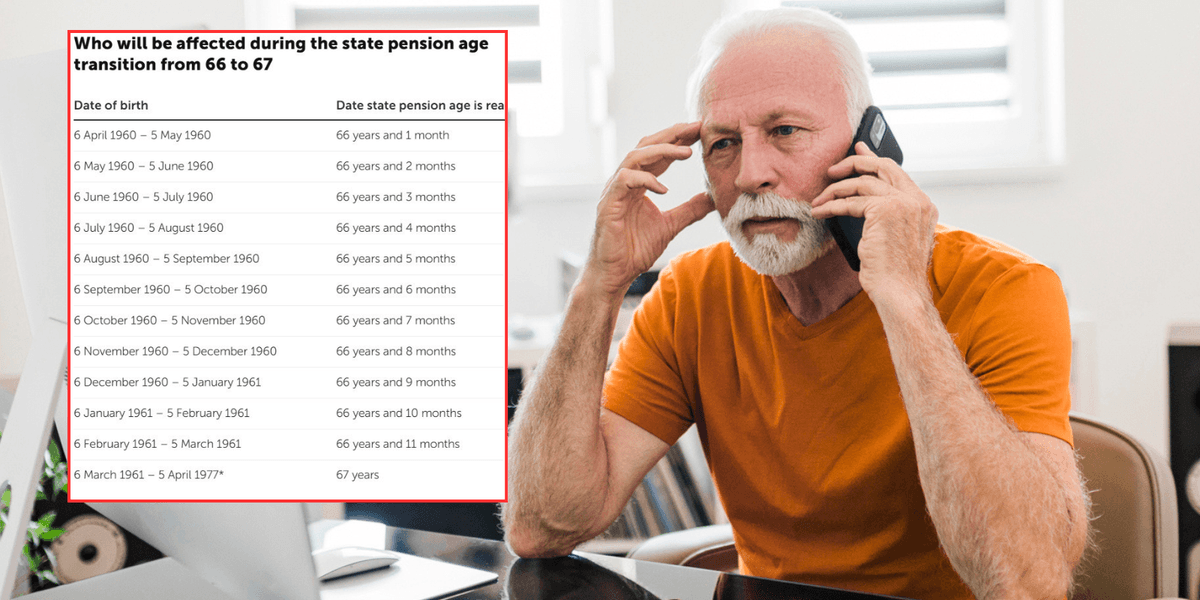

Britons are bolstering their retirement income through annuities

|

GETTY

The wealthiest retirees are driving much of this growth, with purchases exceeding £250,000 jumping by 31 per cent compared to the previous year.

Even more striking, annuities valued above £500,000 surged by 54 per cent demonstrating a clear appetite among affluent savers to lock in substantial guaranteed income streams.

Interestingly, this boom in premium values has occurred despite a modest decline in the overall number of annuities sold during the period.

Notably, the ABI attributed this apparent contradiction to individuals choosing to annuitise considerably larger pension pots rather than smaller sums.

Annuities, which offer guaranteed income for life, are often overlooked by those not seeking proper guidance | GETTY

This trend suggests that those with substantial retirement savings are increasingly prioritising the security of a fixed income for life over maintaining flexibility with their funds.

Rob Yuille, assistant director and head of long-term savings at the ABI, said: “A striking feature of this year’s data is the increase in the size of pots being annuitised, paired with people choosing to secure a regular income at older ages.”

He advocated the “flex then fix” approach, where retirees use savings flexibly in early retirement before locking in guaranteed income when certainty becomes paramount.

Sir Steve Webb, former pensions minister and now partner at consultants LCP, said: “There is no doubt that annuities are enjoying a renaissance, particularly at the higher end of the market and amongst those who take financial advice.”

He pointed to the recovery of annuity rates from their extremely low levels during the 2010s as a key factor, alongside the forthcoming inclusion of pensions within inheritance tax from April 2027.

Mr Webb noted that some savers are likely combining substantial annuity income with other retirement funds to create surplus cash they can regularly gift to heirs, potentially qualifying for inheritance tax exemptions under HM Revenue and Custom’s gifting rules.

David Cooper, director at retirement specialist Just Group, said: “There is a clear shift at the upper end of the market for savers with larger defined contribution pots to prioritise security and lock in predictable income streams.”

Carolyn Jones, retirement director at Scottish Widows, said: “More people are choosing annuities because they want greater certainty in an unpredictable economic climate.”

Using an annuity search engine is crucial for retirees to understand what the market can offer before making their final decision | GETTY

She added that guaranteed lifetime income provides genuine reassurance, eliminating concerns about savings longevity or market volatility, with larger pension pots increasingly being directed toward annuities as customers seek long-term stability.

Marianna Hunt, personal finance specialist at Fidelity International, highlighted how improved rates have transformed retirement income prospects.

She said: “As of December 2025, a 66-year-old in good health with a £300,000 pension pot could buy a single-life annuity paying £22,447 a year, according to figures from our own wealth management team.”

This compares to approximately £13,500 from an identical pot five years earlier, representing a substantial increase in guaranteed income.