The Labour Government is being urged to reconsider its plans to overhaul the pension system with stakeholders claiming they are “sceptical” the proposed changes would offer diminished returns down the line.

Last year, the Treasury confirmed Chancellor Rachel Reeves’s intention to create pension megafunds as part of the “biggest reforms in decades”. This initiative will consolidate defined contribution (DC) schemes and pooling assets from the 86 separate Local Government Pension Scheme authorities.

According to the Government’s estimates, megafunds would generate around £80billion in investment that would be given to new businesses and critical infrastructure.

The Pensions Investment Review 2024 found that pension funds start to return much greater productive investment levels once the size of assets they manage reaches between £25-50billion.

However, pension fund managers are calling on Labour to direct its attention towards optimising retirement savings for Britons instead of introducing an “arbitrary” scale test on the industry.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

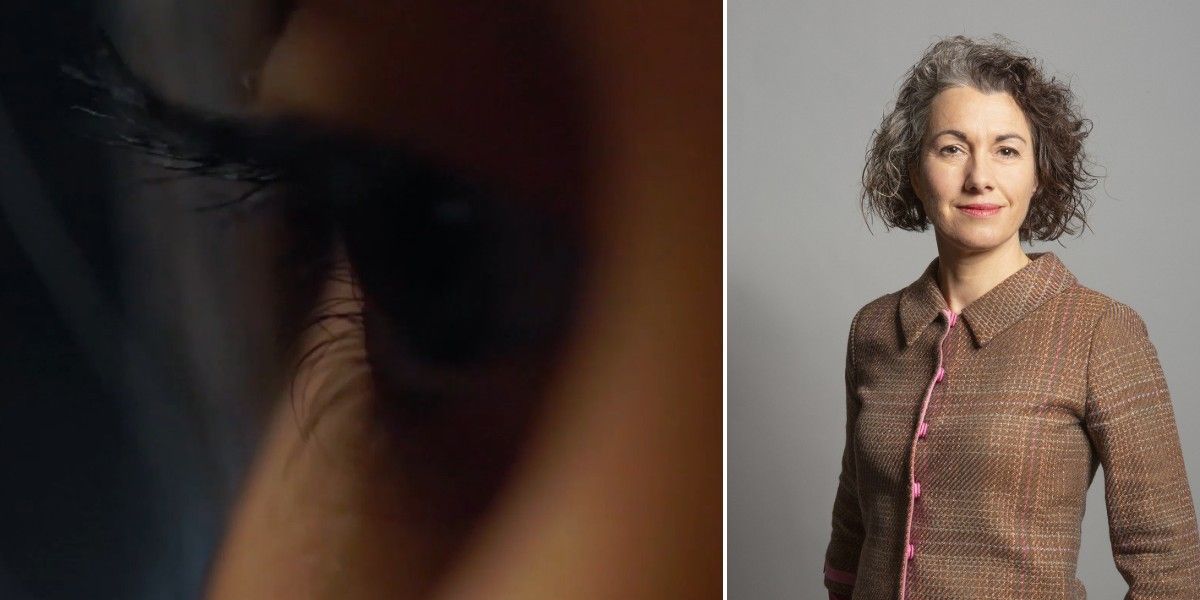

The Government is being asked to reconsider its plans for pensions

PA / GETTY

Specifically, fund managers claim the pension system overhaul would disincentivise new entrants to the market and force competitive schemes to combine with underperforming ones.

As it stands, Britain has around 60 multi employer DC pension schemes which an overall asset portfolio that is projected to reach £800billion by the end of this decade.

Following a consultation into the proposal, the Government claimed the transition towards megafunds would result in a “much smaller” number of schemes operating in the UK.

This consolidation within the pension market is being pushed by Labour to ensure funds have managed assets totalling £25billion. According to the Government, this is the threshold schemes need to hit in order to earn greater investment levels.

Jamie Fiveash, the chief investment officer at Smart Pensions, is among the managers sounding the alarm of potential unintended consequences resulting from the changes.

He explained: “We’re obviously supportive of scale benefits but what we don’t want to do is create an oligopoly. . . we are concerned that with what’s being proposed competition and innovation will suffer and we’ll end up more like a utility market where there’s a lot of issues as we know.

Notably, fund managers have scrutinised the Government’s methodology when drawing out the plans for the overhaul as DC funds were compared with superannuation funds in Australia.

DC funds in Britain are estimated to have around four per cent of assets in private equity and infrastructure, with the Australian funds being larger at 13 per cent across two asset classes in comparison.

Speaking to The Financial Times, SEI Institutional Group’s managing director Steve Charlton shared: “The Australian system has had years to carefully select its opportunities and evolve its structures. . . you don’t get the benefits of scale by just squashing people together and saying there, it works.

“We have seen circumstances where the top end of performance is overlooked in favour of those chosen based on scale. Advisers may satisfy themselves that mediocre is fine.”

LATEST DEVELOPMENTS:

Reeves is making drastic changes to the pension system which could impact returns

GETTY/GB NEWS

Furthermore, pension fund managers have noted the 2030 deadline for the transition to megafunds may be too ambitious as schemes often take years to merge together.

David Lane, the chief executive of TPT, said: “We are concerned about the pace . . . you need an 18 month to two-year runway [to merge schemes] . . . employers were making decisions on their pension providers almost immediately after the announcement.”

In the announcement of the changes to the pension industry, Chancellor Rachel Reeves said: “[The] Budget fixed the foundations to restore economic stability and put our public services on a firmer footing. Now we’re going for growth.

“Now, we’re going for growth. That starts with the biggest set of reforms to the pensions market in decades to unlock tens of billions of pounds of investment in business and infrastructure, boost people’s savings in retirement and drive economic growth so we can make every part of Britain better off.”

GB News has contacted the Department for Work and Pensions (DWP) for comment.