Sir Keir Starmer has given the green light for local authorities to raise council tax bills by 5 per cent next year, adding £110 onto the average family’s bill.

The rise- over three times the rate of inflation- is set to be used by many cash-strapped councils on the brink of financial collapse.

Years of financial mismanagement and cuts to central government funding have left councils like Birmingham, the largest in Europe, issuing section 114 notices, effectively declaring bankruptcy.

One report in February found that 90 per cent of councils in England and Wales faced bankruptcy within the next parliament unless drastic increases in bills and cuts to services were made.

Average price increases for Brits will depend on what council tax band your house/flat is in.

For example, the average “Band D” property in England will incur an extra £109 a year, while those in the most expensive “Band H” households will see an increase of £217.

With the news of Rachel Reeves’ record tax-raising budget, this will come as blow to many families currently readjusting their finances. But it could get worse.

It is widely known the council tax system is hopelessly out of date. Most properties were assigned a band on their value in 1991, with anything built after that placed via an estimate.

This means that many thousands of properties in London and the southeast pay far less council tax than they should because, since 1991, house prices here have increased sevenfold, compared to fourfold in some northern regions.

The antiquated system means council tax receipts in Westminster represents 0.06pc of property values on average, compared to 1.31pc for properties in Hartlepool.

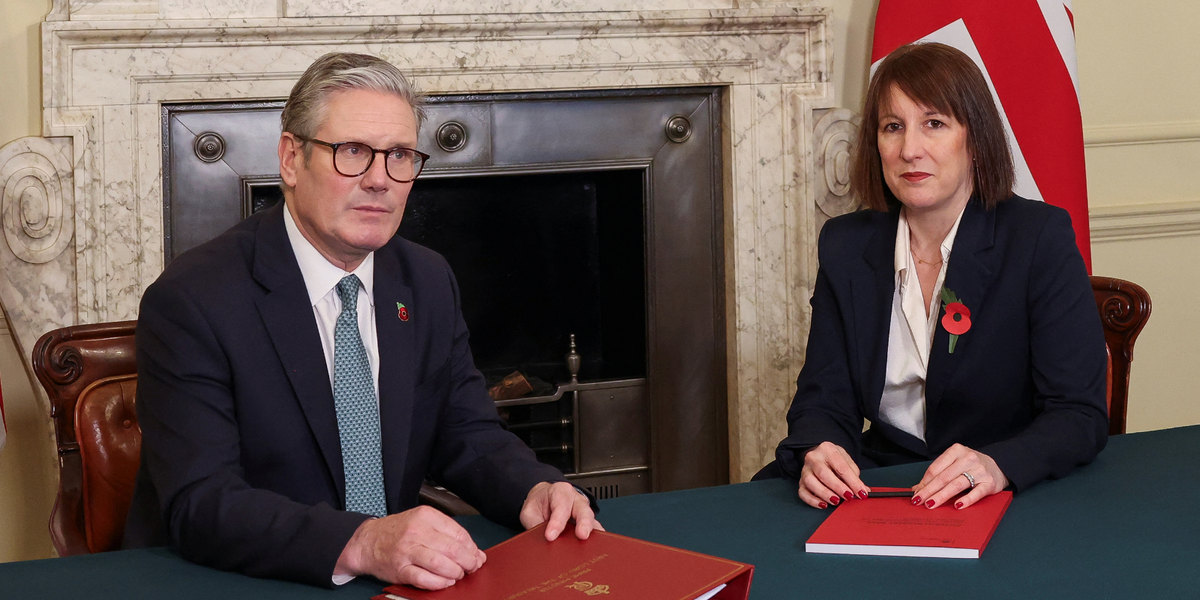

The five per cent rise in April will therefore mean Keir Starmer and Rachel Reeves, residents of No 10 and No 11, will see their council tax bills rise by hundreds of pounds less than an equivalent property in somewhere like Nottingham.

The five per cent rise in April next year may just be the tip of an iceberg, however.

LATEST FROM MEMBERSHIP:

Rachel Reeves, who is clearly not scared of imposing controversial taxes given her farm tax raid, may look to overhaul the outdated council tax system as a means of saving councils on the financial brink.

Whacking up people’s council tax bills will of course be deeply unpopular, but experts have pointed out she has good political cover given the rapidly deteriorating services councils provide.

Highly influential think tank The Institute for Fiscal Studies has argued for council tax reform alongside changes to stamp duty.

In June, it proposed “raising less from high-value properties via stamp duty and more from a revalued-and-reformed council tax would be fairer and better for growth”.

The same think tank lobbied for reform to farmers’ inheritance tax relief.

It remains to be seen whether Reeves will overhaul the council tax system. For now, many families will be hoping the five per cent rise in April isn’t the start of a slippery slope.