The amount collected in inheritance tax has soared 8 per cent to a record £5.7 billion, figures show.

The Treasury raked in the huge amount between April and December 2023 – £400 million more than the same period the previous year.

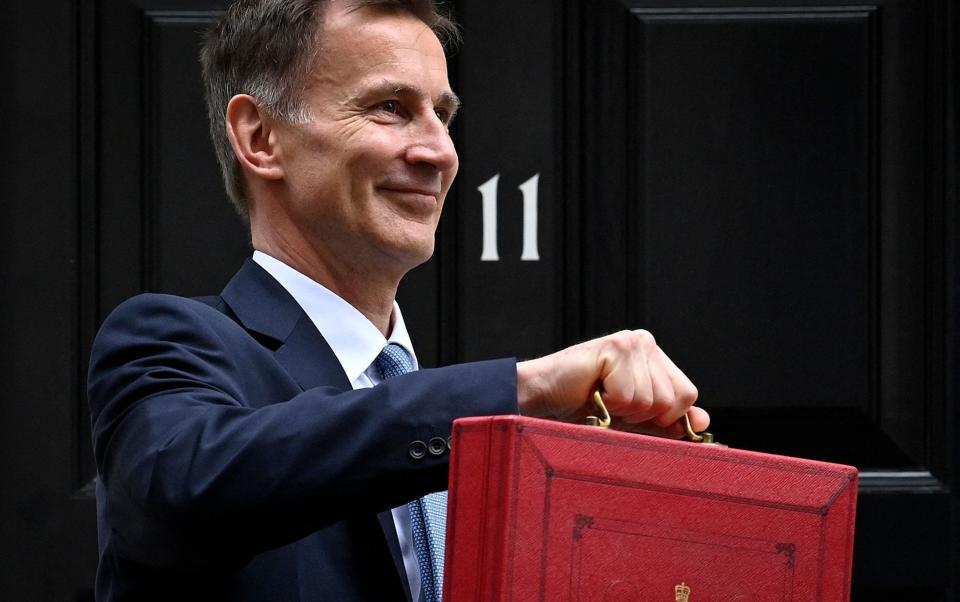

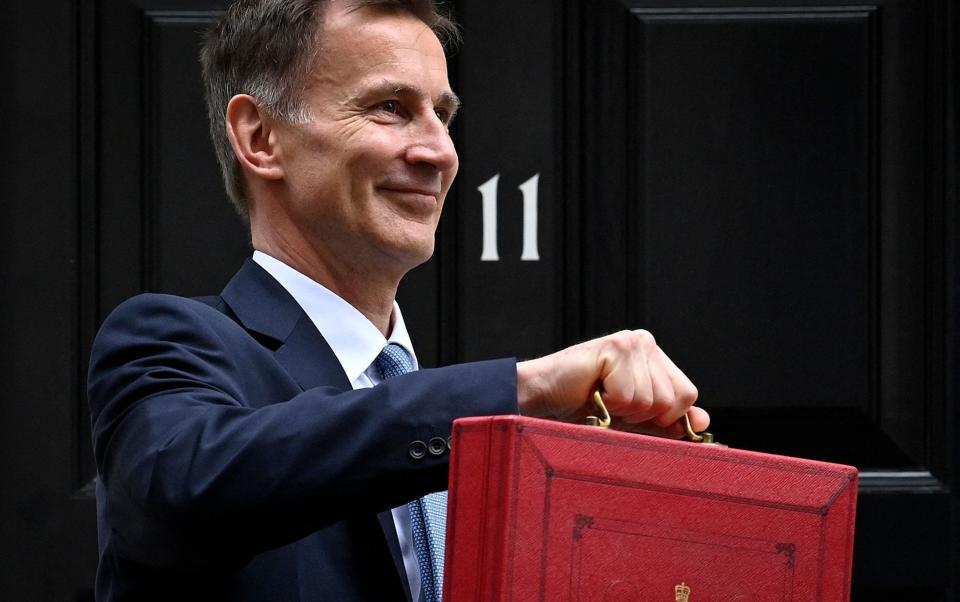

It comes amid pressure on the Chancellor from Tory MPs to reduce the tax or even scrap it altogether.

Earlier this month Jeremy Hunt, who has made it clear he is considering cutting it, called the tax “pernicious”.

One in every 25 estates pays inheritance tax, which is charged at 40 per cent above an estate of £325,000, or £500,000 if passed to a direct descendent.

The number increases every year because the inheritance tax threshold has been frozen for some years, and because house prices have been rising for decades – increasing the size of estates.

Wealth Club, an investment service, has calculated that the average inheritance tax bill could increase to £239,000 this year, with more than 30,000 families having to hand over part of their inheritance to the taxman.

This is a 11.5 per cent increase from the £214,000 average paid three years ago and a 14 per cent rise in the number of estates paying the tax.

Last night Sir Jacob Rees-Mogg, the former business secretary, said: “Inheritance tax is an economically inefficient tax which even after this record rise raises relatively little. It should be abolished.”

Nicholas Hyett, an investment manager at Wealth Club, said: “Cutting rates might win votes, since many see inheritance tax as an unjust grab for money that’s already been taxed once.

“But the revenue earned is playing an important part in the Government’s spending programme, and a shortfall would need to be made up somewhere else.

“Inheritance tax doesn’t just affect the super-rich. Frozen tax brackets mean many who would not consider themselves wealthy will find themselves falling into the inheritance tax bracket in future.

“Their standard of living hasn’t changed; indeed, inflation means it might have gone backwards, but the Government now considers them to be wealthy enough to face inheritance tax.”

Stephen Lowe, from Just Group, a retirement specialist, said at the current rate of collection, inheritance tax will raise around £7.6 billion for the Treasury in this financial year, far surpassing the Office for Budget Responsibility’s forecast of £7.2 billion as well as last year’s all-time high of £7.1 billion.

“We are now three-quarters of the way through the 2023/24 financial year and it is evident that the Chancellor can once again bank on record-busting inheritance tax receipts for a third successive year,” he said.

“Freezing the thresholds has dragged more households into paying inheritance tax especially when combined with the property price rises of the last five years or so.

Laura Hayward, a tax partner at wealth management firm Evelyn Partners, said: “Inheritance tax is harvesting more in revenue than was ever forecast as rising house prices and growth in investment assets have boosted the value of estates over the last couple of decades.

“This has drawn more estates, and more assets in each liable estate, over the threshold at which IHT kicks in, which has been frozen at £325,000 since April 2009. Modest property downturns as we have seen in the last year or so will do little to dent this trend.

“In recent years there has also been a Covid effect on mortality which has further increased the overall IHT take.”