HM Revenue and Customs (HMRC) is issuing timely reminders about Self Assessment tax payments as households across Britain focus on Christmas preparations.

The tax authority is highlighting options for taxpayers to manage their financial commitments during the festive period. The deadline for filing online Self Assessment tax returns and paying any tax owed is January 31, 2025.

Ahead of the deadline, HMRC is encouraging eligible taxpayers to consider spreading their tax payments through payment plans, offering flexibility during what can be a financially demanding time of year.

More than 15,000 Self Assessment customers have already taken advantage of payment arrangements for the 2023 to 2024 tax year.

Under HMRC’s Time to Pay system, taxpayers who owe less than £30,000 can arrange flexible payment plans online without direct contact with the tax office.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

Self-Assessment HMRC customers need to pay any owed tax in the New Year

GETTY

Those owing more than £30,000 can still access payment arrangements but must contact HMRC directly to discuss their options. The scheme allows taxpayers to spread their payments across up to 12 monthly instalments, providing greater financial flexibility.

Importantly, taxpayers must complete their Self Assessment tax return before they can set up any Time to Pay arrangement. The system is designed to support customers who are unable to pay their tax bill in full and need to manage their payments in regular instalments.

This online self-service option offers a quick and straightforward way for eligible taxpayers to arrange their payments.

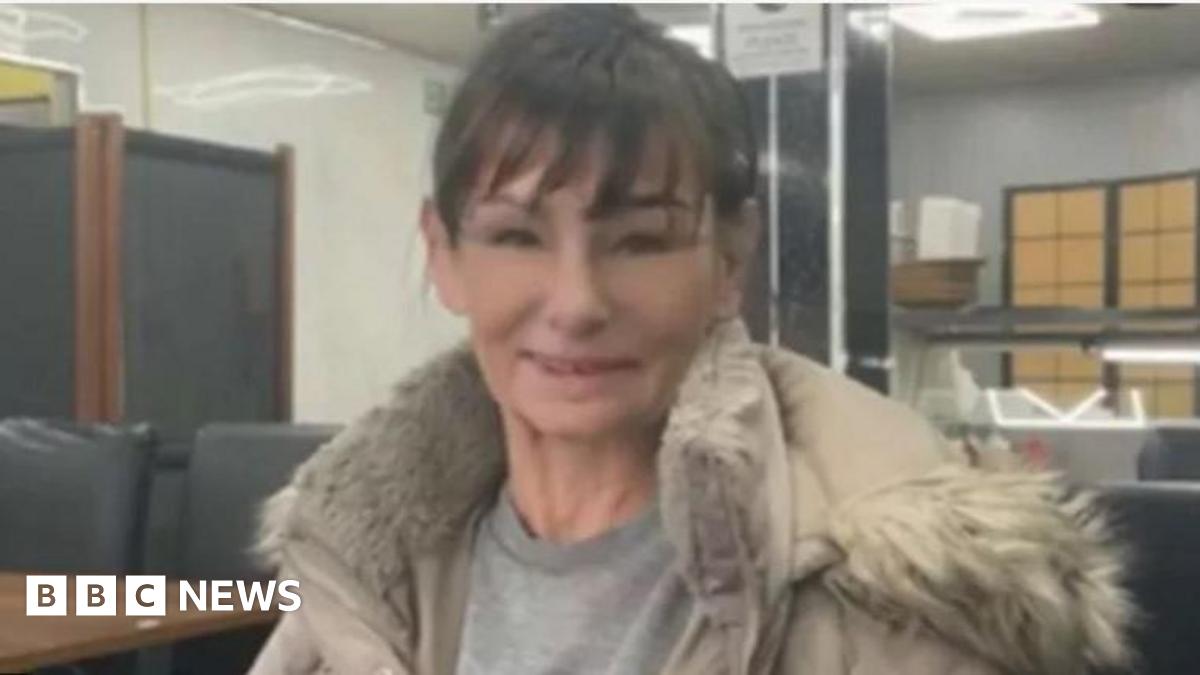

Myrtle Lloyd, HMRC’s Director General for Customer Services, emphasised the tax authority’s commitment to supporting customers.

“We’re here to help customers get their tax right and if you are worried about how to pay your Self Assessment bill, help and support is available,” she said.

“Customers can set up their online payment plan to suit their own financial circumstances and can spread those payments across a maximum of 12 months.”

Lloyd added: “It is a valuable option for someone needing extra flexibility in meeting their tax obligations.”

The flexible payment arrangements aim to make tax compliance more manageable for Self Assessment customers. HMRC has outlined multiple convenient ways for taxpayers to settle their Self Assessment bills.

Payments can be made through the free and secure HMRC app. Taxpayers can also make payments directly through the GOV.UK website.

Online banking remains a popular option, with payments possible through personal online bank accounts.

Telephone banking services are available for those preferring to manage payments by phone. Debit or corporate credit card payments can be processed through banks or building societies.

HMRC has also made educational resources available, including a YouTube video explaining Self Assessment tax bills and payment methods.