A leading investment boss has issued a stinging rebuke of Rachel Reeves’ latest ISA overhaul, warning that new “hurdles” are actively scaring Britons away from the stock market and making it harder for hard-working families to build long-term wealth.

Speaking to GB News, Wander Rutgers, CEO of the investment platform Lightyear, slammed the increasing complexity of the UK’s tax-free savings wrappers.

He warned that while the Chancellor talks a good game about a “nation of savers,” her policies are creating “fear” rather than financial freedom.

The Treasury has come under fire for a series of controversial tweaks to ISA rules, including the plan to slash the Cash ISA allowance to £12,000 for those under 65.

Chancellor Rachel Reeves announced in the November 2025 Autumn Budget that the annual tax-free cash ISA allowance will be reduced from £20,000 to £12,000 for those under 65, effective from April 2027.

This measure aims to encourage investing in UK stocks and shares, while the overall £20,000 allowance remains unchanged.

Mr Rutgers argued that instead of simplifying the system, the Government is adding layers of bureaucracy that punish those trying to grow their money.

He told GB News for an Originals video: “I think that is the wrong way to go. I think that creates more fear for people, another reason not to invest.

“I would go in completely the other direction and actually create ‘One ISA.’ Combine the Cash ISA and the Stocks and Shares ISA and remove many of the restrictions on instruments.

“That way, when people invest, they can very easily ‘graduate’ from a cash product to a shares product. I think that would massively improve the ease of understanding people have around investing.

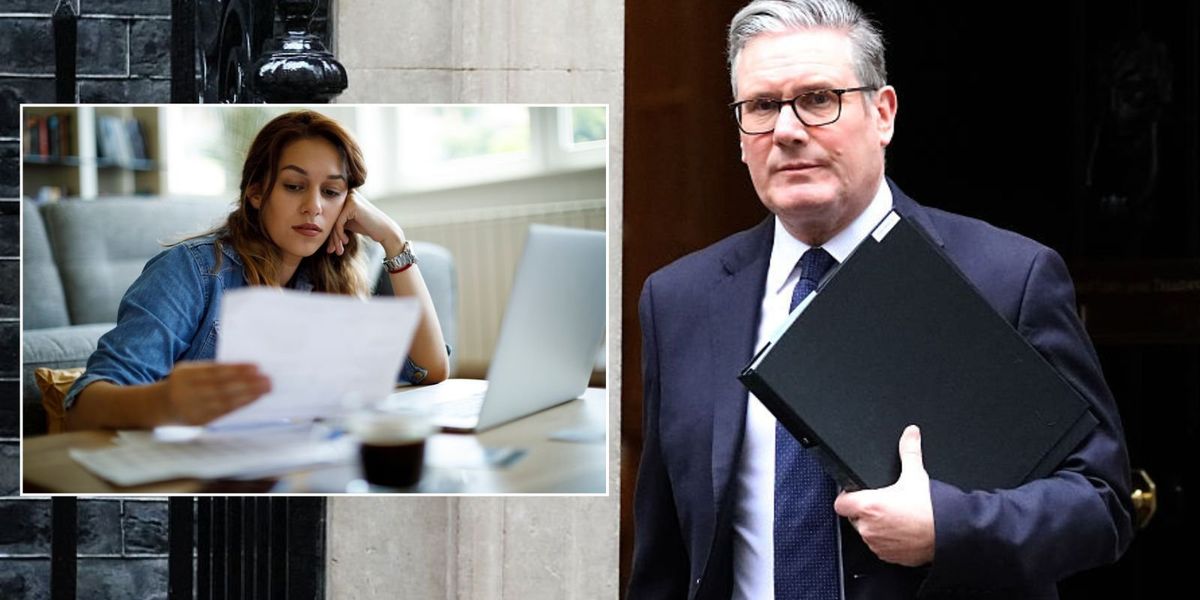

Wander Rutgers, CEO of the investment platform Lightyear, slammed the increasing complexity of the UK’s tax-free savings wrappers

|

GB NEWS

“The simplest answer is that your money works harder for you when it’s in the market than when it’s sitting in a savings account.

“Historically, it is easiest to demonstrate this with a simple example: we did some research on what would happen if you wanted to save for, say, your child’s education over a period of 18 years.

“We compared putting that money into the UK stock market against putting it into a Cash ISA over the last ten years of returns.

“What you learn is that over 18 years, you have to invest double the amount in a Cash ISA to end up with the same amount as you would in a Stocks and Shares ISA, because the returns in the stock market are much greater.

Rachel Reeves announced in the November 2025 Autumn Budget that the annual tax-free cash ISA allowance will be reduced from £20,000 to £12,000

|

PA“To put it simply: if you put £1,200 a year into a market account, you end up with the same amount as putting £2,400 a year into a savings account. Your money works twice as hard in the stock market.

“That doesn’t mean there isn’t a role for cash. The stock market has ups and downs, so money that you need in the shorter term is much better placed in a savings account.

“The returns there are historically lower, but they are much more stable. That is actually what we see our customers doing; they don’t just choose one or the other.

“They combine both because they have different goals, and different ways of investing are appropriate for those different goals. That is probably what is right for most people.”

Asked, by GB News reporter Patrick O’Donnell: “Would removing stamp duty on UK shares meaningfully change retail investor behaviour?”

He explained: “Regarding Stamp Duty, I don’t think it should stop the average investor from giving investing a shot, but it is part of the overall picture.

“If we believe the reason people aren’t investing is because there are already many reasons not to, this is just another deterrent another thing to think about and, more importantly, another fee to incur.

“Fees are very important to customers. A big reason why people have not historically invested much is because it was impossible to do so without high fees.

“You used to have commission fees of up to £10 just to buy a stock, which made it prohibitively expensive for most people because that fee would eat up most of the expected return.

At Lightyear, we care a lot about fees. Removing Stamp Duty would simply remove another fee from the equation, making it that little bit easier for users to get started.

“But the most important thing is to pick an investing platform that doesn’t burden you with fees in the first place.

“If you buy an Exchange Traded Fund (ETF) that tracks the market, Stamp Duty doesn’t really apply to you anyway. Over the long run, a 0.5 per cent Stamp Duty is quite low compared to other potential fees or the returns of the stock market.”