Essex County Council is set to debate a motion calling for millions of pounds in Vehicle Excise Duty paid by local motorists to be spent exclusively on maintaining the county’s roads.

The Conservative-led motion, which will be discussed at the full council meeting on December 10, aims to redirect car tax revenue from the Treasury’s general fund back to Essex.

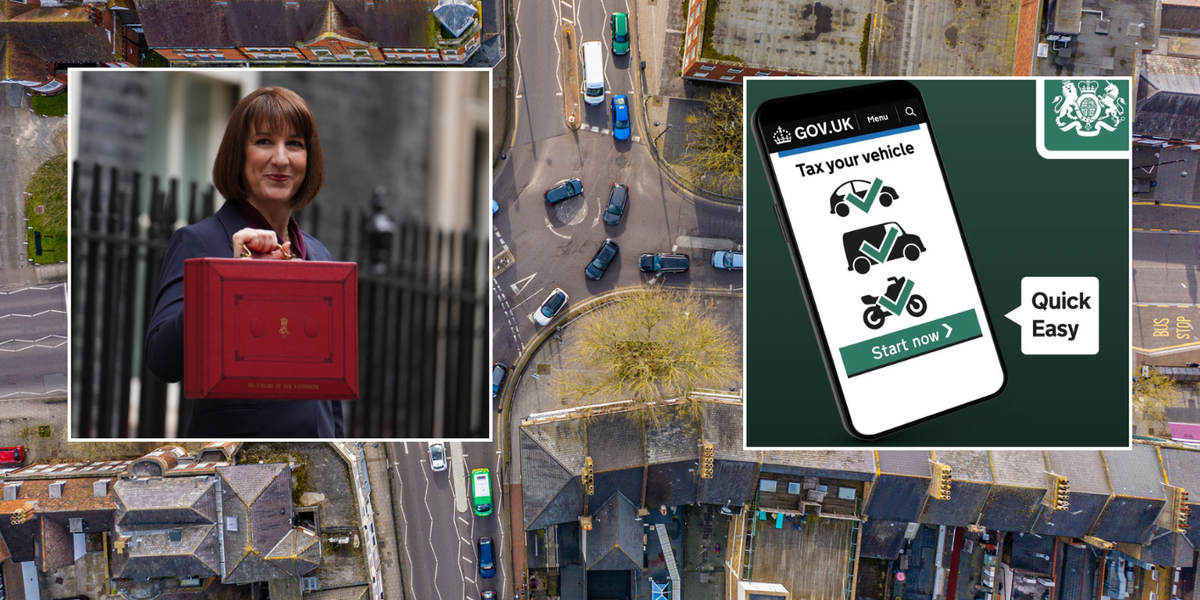

The proposal comes as motorists face huge car tax hikes in April 2025, with significant changes to VED bands on the horizon.

Due to the hikes, the council argued that contributions from drivers in Essex should directly benefit local road maintenance rather than being absorbed into the national fund.

Do you have a story you’d like to share? Get in touch by emailingmotoring@gbnews.uk

The council will discuss the motion at the full meeting on December 10

PA/GETTY

The motion, to be moved by Councillor Mark Durham and seconded by Councillor Kevin Bentley, directly addresses the allocation of Vehicle Excise Duty funds.

It adds: “This council notes that Essex motorists pay millions of pounds in car tax each year. This council believes that all this money should be spent on maintaining Essex’s roads, not topping up the Treasury’s coffers”.

The proposal calls on the Government to add the amount paid by Essex residents to the council’s budget settlement for 2025/26 onwards.

If approved, the Cabinet Member for Highways Maintenance and Sustainable Transport will be tasked with sending copies to the Chancellor, Transport Secretary and all Essex MPs.

However, the Treasury has firmly rejected the possibility of Essex’s proposal being implemented.Officials stated that VED revenues are paid into the consolidated fund, which finances public services across the nation.

The Treasury confirmed there are “currently no plans to hypothecate VED revenues to specific local authorities”. This response effectively blocks Essex County Council’s ambition to secure dedicated road maintenance funding from local car tax payments.

The decision maintains the current system where VED contributes to general public spending rather than being allocated to specific regional transport projects.

The calls for taxes to be devolved come after Chancellor Rachel Reeves announced significant changes to VED tax bands for new cars from April 2025.

Cars emitting between 1 to 50 g/km of CO2, including most plug-in hybrids, will see their first-year tax rise to £110. This marks a notable change, as hybrids in this band currently pay nothing in their first year, while petrol and diesel vehicles pay £10.

New vehicles producing between 51 to 75g/km of CO2 will face an increase from £30 (or £20 for hybrids) to £135. The changes are part of a broader initiative to encourage electric vehicle adoption. All other VED rates are set to double in the coming year.

The financial impact of these changes will vary significantly depending on vehicle type.The owner of a new Volkswagen Golf 1.5 TSI will need to pay anadditional £220 in the first year under the new system.

The changes will hit luxury vehicle owners particularly hard, with a new BMW X5 M60i facing an extra £2,745 on its first-year rate.

LATEST DEVELOPMENTS:

Standard VED rates beyond the first year will continue to rise in line with the Retail Price Index, as per usual practice.