Paedophile financier Jeffrey Epstein stood to make millions from tip-offs given to him by Peter Mandelson while he was at the heart of the British government, experts revealed yesterday.

Lord Mandelson told Epstein about then-prime minister Gordon Brown’s resignation in May 2010 hours before it was made public, emails appear to reveal.

Around the same time, he gave Epstein advance notice of a €500billion (£432billion) bailout for the euro during a major crisis for the single currency, the documents suggest.

Both developments took place against the background of highly volatile currency markets and would have been ‘gold dust’ on the markets, it was claimed.

The tips could have proved hugely lucrative to an agile trader using them to make bets on the pound or the euro.

Ken Costa, former chairman of investment bank Lazard, said the advanced notice allegedly provided by Mandelson could have been significant in a world of trading where the ability to get ahead of the market by just seconds is highly prized.

‘Anybody that has a timing advantage, however small it might be – both a timing advantage and from a reliable source – it’s gold dust,’ Mr Costa said.

He pointed to the kind of sums that could be made in the currency market by citing the example of George Soros, who became known as the man who ‘broke the Bank of England’ when he earned £1billion betting against the pound – though not with insider information.

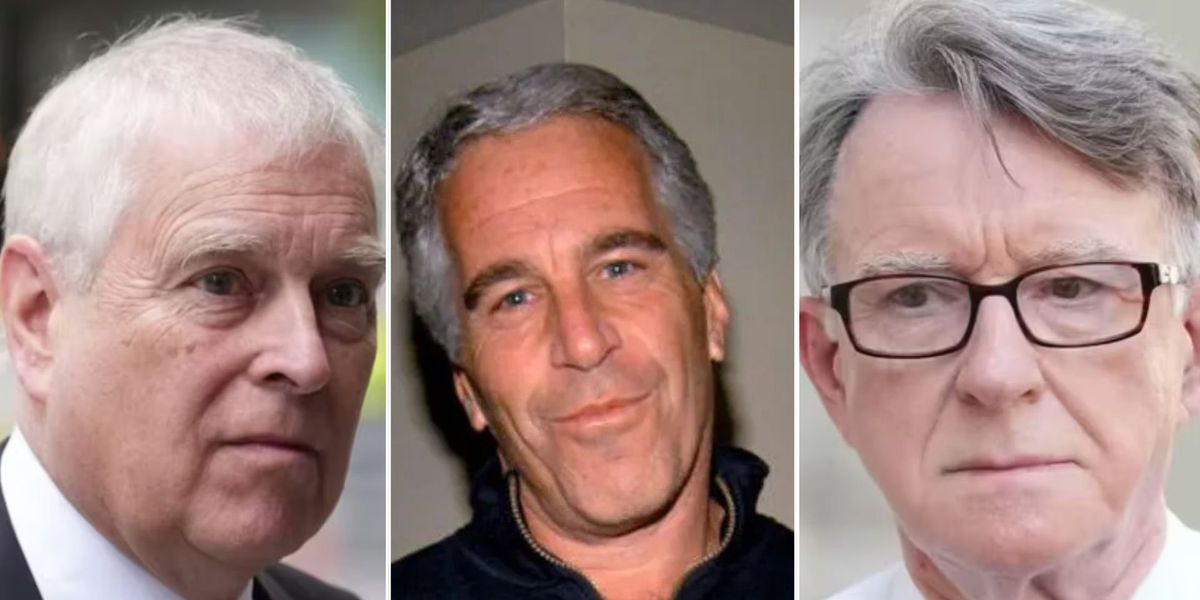

Peter Mandelson (left) previously claimed he was ‘kept separate’ from the ‘sexual side’ of paedophile financier Jeffrey Epstein (right)

The pair (pictured) exchanged hundreds of emails, many of which were laced with sexual innuendo or even brazen references to sex

A picture released by the US Department of Justice shows Mandelson with an unidentified individual

Hedge funds and other financial operators can spend vast sums to gain an advantage, such as private polling ahead of an election. Yet that would be dwarfed by ‘hearing the deputy prime minister tell you something’, Mr Costa said.

Mandelson’s tips to Epstein came at a time of major upheaval that saw wild swings on currency markets. The pound was on edge in the wake of an election which ultimately ended Mr Brown’s premiership, but only after days of uncertainty and political horse trading that sent the currency one way and then the other.

After the election on May 6, traders feared Mr Brown was trying to cling to power in an unstable minority government propped up by the Liberal Democrats – and was dubbed a squatter in Downing Street.

All the while, Mandelson – at the time the deputy prime minister – was briefing Epstein on Labour’s secret talks with Nick Clegg’s party, emails show.

By May 11, the writing was on the wall for Mr Brown, and Mandelson told Epstein that morning: ‘It’s over. I am out of govt at the end of the day.’

That gave Epstein a potential headstart versus the market as the announcement of the PM’s resignation would not come until that evening, boosting the pound as a Tory-Lib Dem coalition was seen as more stable.

It is not known whether – and if so, when – Epstein used any of the information he received to place bets on the pound. But from its lowest point that day at just over $1.47 to its highest at $1.50, it moved by 2.89p or 289 ‘basis points’.

Investors tend to use sophisticated but risky strategies to bet on currencies rather than buying the currencies themselves. By ‘spread betting’ – for example a £10,000 per basis point rise – an investor could have made £2.89million that day.

Sir Keir Starmer (right) handpicked Lord Mandelson (left) as US ambassador before being forced to sack him in September over his ties to paedophile Jeffrey Epstein, who died in 2019

The tranche of documents includes an email seemingly from Lord Mandelson to Epstein, talking about the UK government having ‘saleable’ assets

Mandelson and Epstein appeared to message each other mocking the then Prime Minister Gordon Brown’s inevitable departure just days before he resigned in 2010

Trading in the euro had been even more volatile. Over the course of 2010 it had plummeted from $1.43 against the dollar to less than $1.28. EU ministers thrashed out a €500billion rescue announced in the early hours of May 10, helping the euro spike close to €1.31.

Again, Epstein appears to have had advanced warning from Mandelson the previous evening.

When Epstein said ‘sources tell me 500b euro bailout, almost complete’, the then- business secretary replied: ‘Sd [should] be announced tonight.’

Mr Costa said: ‘The real question is: did he [Epstein] do anything with it, did he benefit?’

That may have meant passing information to another party, but there had not been a ‘smoking gun’ showing this. Mr Costa said: ‘The mere fact of disclosing would under normal circumstances be a sackable offence if you were in the government.’

Jane Foley, head of FX strategy at Rabobank, said: ‘It is fair to say that any piece of insider information will provide a speculator with an advantage.’

Tory business spokesman Andrew Griffith said: ‘The FCA (Financial Conduct Authority) must investigate what could be one of the biggest insider dealing scandals for decades.’

The FCA declined to comment. Mandelson has not commented on the emails but denies wrongdoing in relation to Epstein. He faces a probe by Scotland Yard into allegations of misconduct in public office.