American entrepreneur Mark Matson has admitted he is concerned about the potential effects of Bitcoin on the global economy – telling his GBN America interviewer Ilka Braverman “I really wish you’d stop talking about it”.

Speaking on the People’s Channel, Matson said the “wildly volatile” cryptocurrency poses a significant threat to investors.

“I think one of the biggest dangers to the American economy and to investors is the whole idea of Bitcoin”, he said.

“In Bitcoin, you have unregistered security. People traded as a security. They traded as an investment. They traded like they would a stock or a bond.

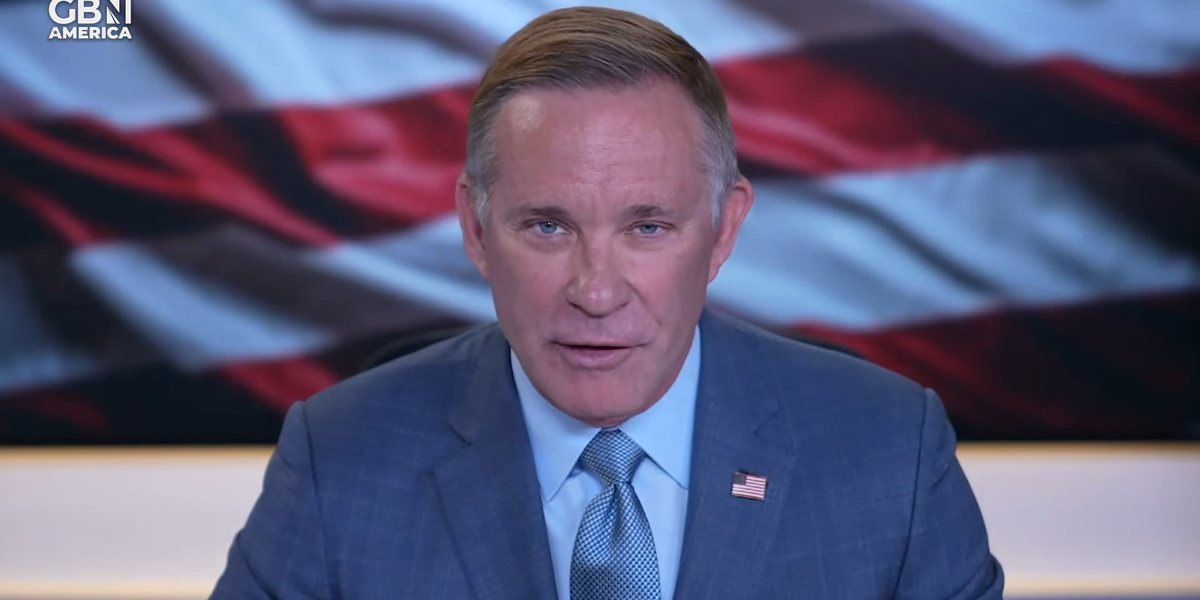

Mark Matson spoke on GBN America

GBN AMERICA

“It’s completely unregulated. If an investment advisor or broker dealer tried to operate like that, the SEC [US Securities and Exchange Commission] would come in very quickly and shut things down.

“They need to get involved with regulating Bitcoin and how it’s advertised and who can buy it and how it works. I know this is counter to the Trump agenda but I’d like to see the SEC get involved with some better regulations.

LATEST DEVELOPMENTS

“They have some regulations that are very negative for the US economy on regular investment advisors and some broker dealers. I think they really need to adjust this Bitcoin issue because I think it’s a problem for America and for the global economy.”

It comes after Trump ally and Senator Cynthia Lummis called on the US Treasury to acquire a significant amount of Bitcoin in the coming years, a move Matson believes would be “disastrous”.

“There’s no benefits whatsoever to doing this”, he told GBN America.

“I think it would be very disastrous. Investors need to understand Bitcoin – when you buy a sock, you actually buy a piece of a company.

Mark Matson speaks on GBN America

GBN AMERICA

“You buy factories, you buy manufacturing, you buy intellectual property, you buy intellectual human capital, so you own a piece of something that is real.

“When you buy a bond from a corporation or from a government, you are buying a promise to get paid back from that corporation or from that country based on taxes or revenues. So you actually have something that is real.

“Bitcoin is not a currency. It has to be stable in price to be effective. It’s wildly volatile, so it can never be a currency. It’s not a coin, it’s actually just electrons floating around in cyberspace. There’s nothing there.”

It comes as the cryptocurrency surged past $100,000 for the first time, marking a historic milestone for the world’s largest cryptocurrency.

The breakthrough came late Wednesday after President-elect Donald Trump nominated Paul Atkins to lead the Securities and Exchange Commission.

Atkins, who runs financial services advisory group Patomak Global Partners and advises the Chamber of Digital Commerce, represents a significant shift from the regulatory approach of outgoing SEC Chair Gary Gensler.

The nomination signals a more crypto-friendly regulatory environment under the incoming administration.