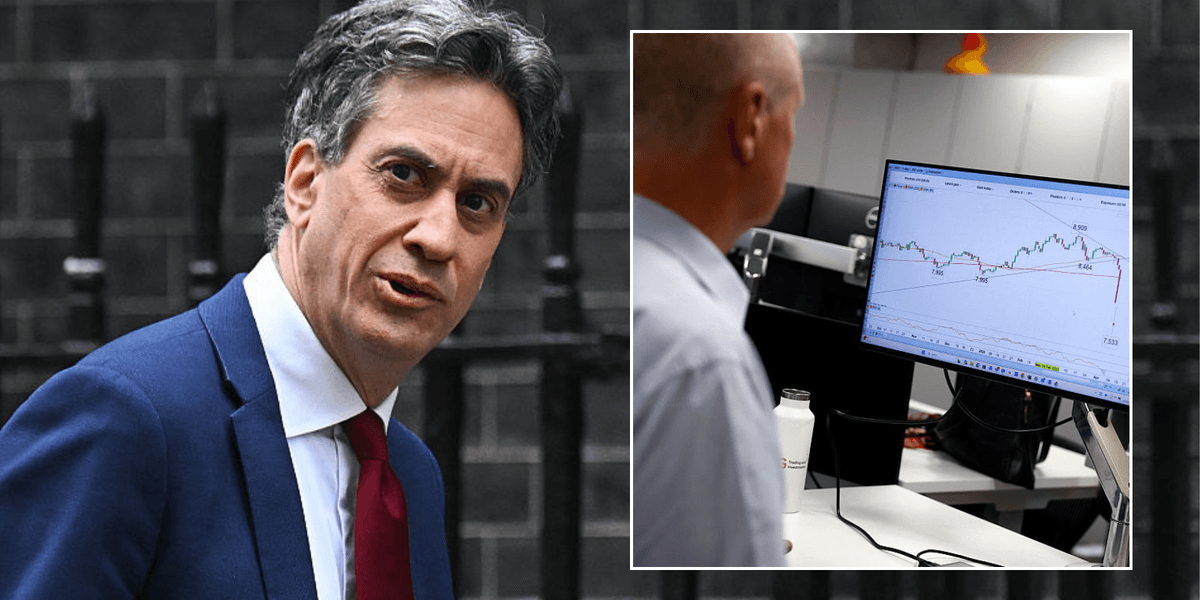

The hefty fall in the share price at the London Stock Exchange Group (LSEG) has made it a sitting duck for activist investors such as Elliott.

As well as being hit by fears AI will torpedo its data and analytics business, there has also been a drought of new share listings, albeit this is easing.

Chief executive David Schwimmer has questions to answer about his £21billion purchase of Refinitiv, which completed in 2021, a deal that repositioned the group from a UK exchange into a global data and analytics powerhouse.

The latter now accounts for around 70 per cent of revenues, compared with just 30 per cent from capital markets.

Critics say LSEG paid a heady price for assets that Thomson Reuters and Blackstone, the previous owners, were keen to offload. LSEG shares are now below their price when the deal went through.

Schwimmer can expect no indulgence from Elliott, a famously unsentimental US operator, that lives up to the activist label, and then some.

AI threat: London Stock Exchange Group chief exec David Schwimmer (pictured) has seen shares fall by more than 35% over the past year

Hyperactive would be more accurate, given its interventions at GSK, Smiths Group, Anglo American, AkzoNobel and BP, where former chief executive Murray Auchincloss recently headed for the exit. The fact that Elliott has intervened looks ominous for Schwimmer.

It hasn’t said what it wants to happen at the LSEG, though it is reported not to be pushing to spin off the exchange side.

The question remains as to whether the LSEG as a whole is greater than the sum of its parts.

Ironically, since the Stock Exchange abandoned its traditional mutual structure in 2000 and floated on its own market a year later, it has rarely been free of bidders, activists and assorted corporate pests.

The formidable Dame Clara Furse, who was chief executive in the noughties, stood for no nonsense.

She fought off an extraordinary string of hostile takeover attempts between 2004 and 2007 from Deutsche Boerse, Nasdaq, Macquarie and Euronext. It’s enough to induce nostalgia for her at the helm.

Sell, sell, sell

Another day, another AI tool and another lot of companies caught in a sell-off, whether they deserve it or not.

Wealth management firms are the latest targets, following hits to LSEG, Relx, comparison websites and insurers, based on fear that AI tools will torpedo profits.

Altruist Corp’s tool claims to help advisers devise personal tax strategies. One critical issue here is AI’s propensity for mistakes and hallucinations.

As an experiment, I asked ChatGPT to model a couple of financial planning scenarios.

It made numerous errors: wrong tax rates, ignored pension rules and omitted National Insurance Contributions.

I spotted the nonsense, but anyone without the relevant knowledge could have been badly misled.

There are people with modest assets who cannot access affordable advice, and AI might reduce the cost of generic guidance.

But it cannot provide real personal financial counsel, which is as much about psychology as facts and figures.

Only humans can do that and the need for flesh and blood wealth managers will probably grow as more people retire on stock market-linked pensions.

AI clearly has the potential to disrupt business models in many industries.

But the current selling feels indiscriminate. Has there been any rational assessment of what these tools do, how well they work or how widely they will be adopted? One suspects not.

That is not to say the sell-offs should be dismissed: such jumpy behaviour is an indication nerves are very frayed indeed.

Idle hands

Business leaders are wary of speaking out about idleness, for fear of seeming callous and of upsetting the Government.

So it was refreshing to hear Ashwin Prasad, the boss of Tesco UK, say that the UK is sleepwalking into a quiet epidemic of worklessness.

As he correctly points out, instead of investing in what might stimulate growth, we are spending more on benefits, while pushing up taxes on those who work.

More than 9m people of working age are out of the job market, classed as ‘economically inactive’.

Nearly 1m people aged 16-24 neither work, nor are in education or training – unsustainable for the economy and harmful to those concerned.

Well said, Mr Prasad! You have spoken out loud what many are thinking.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Freetrade

Freetrade

Investing Isa now free on basic plan

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you