Hotels giant Travelodge has warned recent Labour policies have made trading conditions “more challenging” after the sector missed out on fresh business rates relief.

The criticism came in a trading update published a day after the Treasury confirmed fresh tax support for pubs and live-music venues.

Chief executive Jo Boydell said the decision showed a lack of understanding of the hotel industry’s economic contribution.

“Higher rates and a lack of bespoke support, together with wider regulatory cost increases, sends the message that the Government does not understand the economic value that our sector delivers,” she said.

The budget chain, which operates 625 hotels across the UK, said it was disappointed to be left out of targeted relief while other parts of hospitality received specific support.

Travelodge expects its annual business‑rates bill to jump from £38million last year to £50million from April, warning of further sharp increases as transitional relief is phased out.

UK Hospitality has warned that hotel business rates could rise by 115 per cent by 2029 under changes to commercial property taxation set out in the November Budget.

Although the Treasury introduced a lower multiplier for calculating rates, Travelodge said the benefit had been more than offset by the removal of the pandemic‑era 40 per cent discount for hospitality, leisure and retail businesses.

Travelodge has warned that recent Labour policies show they don’t understand the value of hotels to the UK economy

|

GETTY

New property valuations have also pushed liabilities higher.

On Tuesday, the Government confirmed that English pubs and live‑music venues will receive a 15 per cent business‑rates discount from April.

Travelodge said the exclusion of hotels added to a growing list of pressures, including rising employment costs linked to increases in the national living wage and new regulatory requirements that it said were making growth harder.

“These are direct headwinds to the health of the sector and future investment in a critical element of the UK economy,” Ms Boydell said..

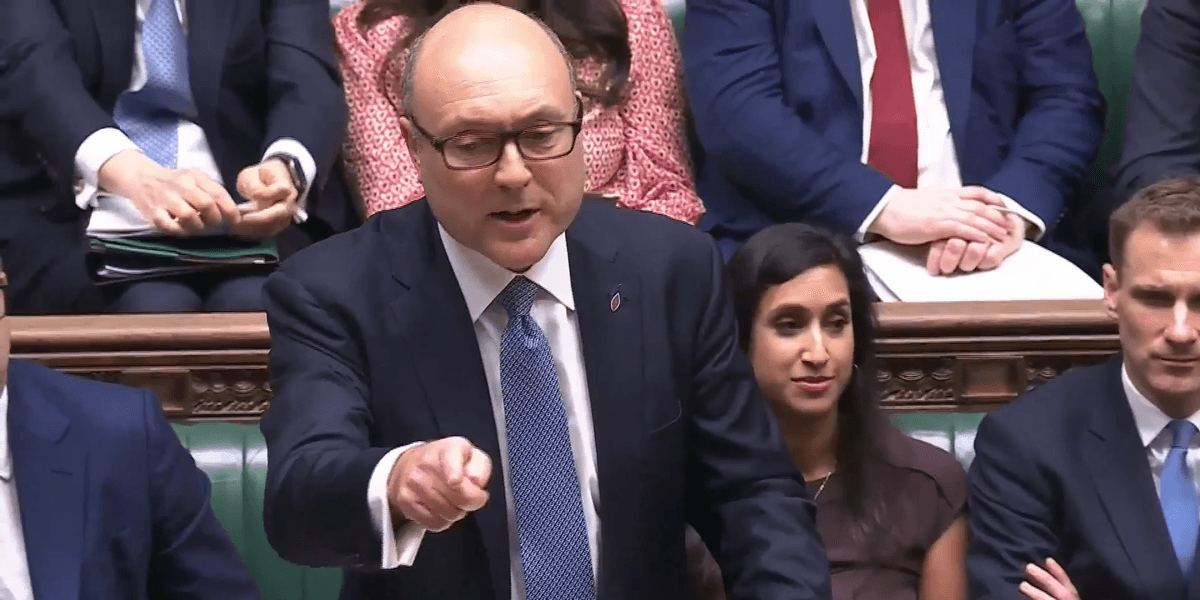

The business rate relief package for pubs was announced by Dan Tomlinson MP on Tuesday

|

GOVThe company warned that the current policy environment risks undermining investment at a time when operators are already grappling with substantial increases in business rates.

Despite the pressures, Travelodge reported improved financial performance in 2025.

Group revenues rose 0.7 per cent to £1.04billion for the year to 31 December, with fourth‑quarter revenues up 4.3 per cent to £261million.

Demand was boosted by major events including the World Travel Market at London’s ExCeL, England’s autumn rugby international against Australia at Twickenham, and Premier League and European football fixtures.

The company also completed its largest development programme in more than a decade, opening 21 new UK hotels and signing additional pipeline deals in the UK and Spain.

Ms Boydell said the business remained confident about its outlook, adding that Travelodge is “well placed for medium‑term growth” due to its brand strength and broad customer base.

The Treasury has not responded directly to Travelodge’s criticism over the exclusion of hotels from the latest business‑rates relief.

In response to the support package, Shadow Chancellor Mel Stride dismissed the announcement as little more than a “sticking plaster”, asking bluntly: “Is this it?”

Mel Stride offered a scathing takedown of the proposals

|

Parliament TVHe argued that, after weeks of promising struggling pubs that meaningful support was coming, the Labour Government had delivered very little.

The measures, he said, would “only delay the pain for a while”, warning that “thousands of businesses are in despair as their bills soar”.

Liberal Democrat Treasury spokesperson Daisy Cooper said the package still left pubs facing higher business rates and offered “nothing at all” to the rest of the high street.

She urged ministers to go further by boosting business rates relief for all retail, hospitality and leisure firms, alongside a one‑year “emergency” VAT cut for the hospitality sector.