Savers in the UK are set to pay more to HM Revenue and Customs (HMRC) as part of a “stealth tax” under Budget reforms, according to Coventry Building Society.

The impact of frozen thresholds and a frozen personal savings allowance is expected to contribute to a significant rise in income tax receipts.

Jeremy Cox, head of Strategy at Coventry Building Society, warns that savers are now paying billions in income tax on their savings annually.

The latest Office for Budget Responsibility (OBR) forecast predicts income tax receipts will reach £311.4billion this tax year, £8.7bn higher than its March forecast.

This figure is projected to rise to £392.1bn by 2029/30 due to the impact of fiscal drag.

Cox projects that if the share of receipts from savers remains constant, they could be paying £11.3bn in income tax on savings interest next year, rising to £13.5bn by 2029/30.

How have you been impacted by the Budget? Get in touch by emailing [email protected].

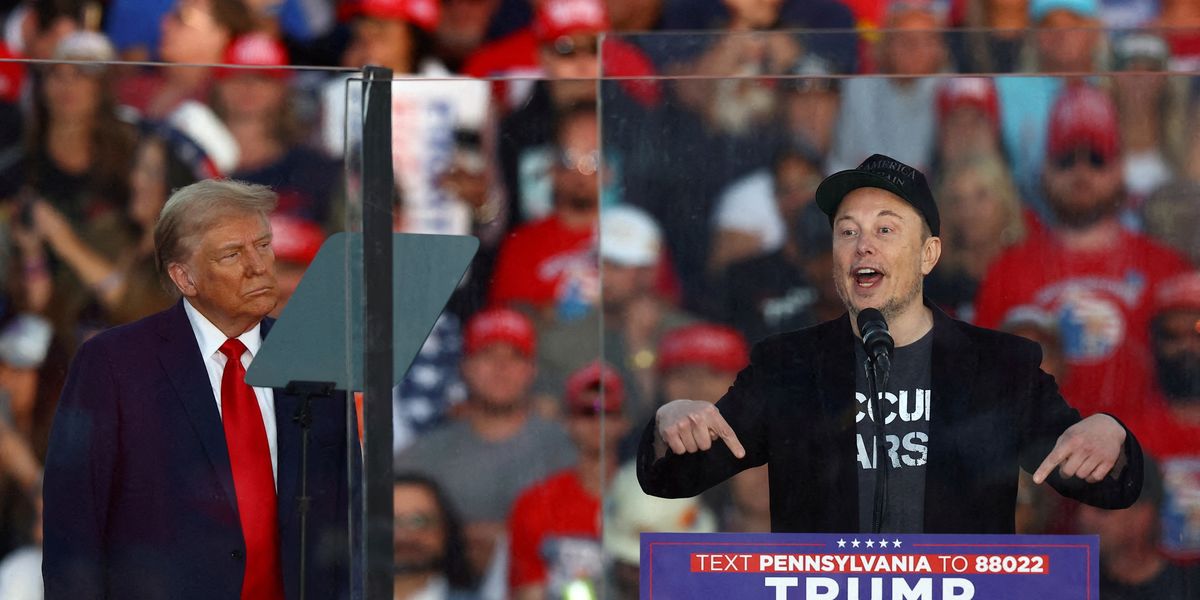

A savings tax raid has been launched, according to Coventry Building Society

GETTY/PA

He notes that the personal savings allowance is quickly exhausted in the current high-interest environment.

A higher rate taxpayer with a savings account paying five per cent would reach their £500 allowance with just a £10,000 balance.

“They would have to pay the taxman 40 per cent of any further interest they received,” Cox warns.

However, he highlights that ISA allowances remain unchanged, allowing individuals to save up to £20,000 tax-free each year.

The concept of fiscal drag refers to how frozen tax thresholds increase taxable income without raising tax rates.

This phenomenon occurs when inflation and wage growth outpace static tax thresholds.

According to OBR estimates, the freezing of income tax thresholds will raise over £33.5bn annually by 2028/29.

This policy has been dubbed a “stealth tax” by some observers. Think tanks like the Resolution Foundation and the Institute for Fiscal Studies have cautioned against long-term reliance on frozen thresholds to boost revenue.

Britons could pay more tax on their savings, according to new research

GETTY

Chancellor Rachel Reeves addressed the issue of income tax and National Insurance thresholds in her recent statement to MPs.

She emphasised that extending the threshold freeze to 2030, as previously rumoured, would “hurt working people” by taking more money from their payslips.

Reeves affirmed her commitment to keeping “every single promise on tax” made in the manifesto. She announced that personal tax thresholds will be uprated in line with inflation from 2028-29.

“When it comes to choices on tax, this Government chooses to protect working people every single time,” the Chancellor stated.